Crypto incentives have devolved into a zero-sum game. Community members now expect to participate with zero investment, and projects have adapted to the reality that most users contribute zero value due to the high percentage of bots and farmers. User expectations are fair given the high % of projects running out of funds after NFT & token sales. Projects, in turn, tolerate low-quality users to meet metrics required for funding and CEX listings. At the end of the day, token incentives are fundamentally broken for both users and projects.

At its core, Web3 incentives are broken for three key reasons:

Sybil activity is not only rampant – it’s often necessary for pre-launch projects as they build hype, but it’s harmful to reward these users.

Crypto Twitter villainizes high spend requirements, claiming they favor whales, leading projects to prioritize easily farmed social signals over genuine financial commitment.

Token distribution is either over-engineered or neglected. Most commonly they either:

Overallocate for the initial TGE.

Fail to distribute tokens at regular intervals following TGE losing momentum.

Background

Airdrops

Let’s start at the beginning of the story for airdrops from $UNI to today. Uniswap CEO Hayden Adams' famous tweet proved prophetic, “At the time we said to ourselves ‘no one can ever replicate this’ because every future airdrop will be gamed.” Today, industrial-scale airdrop farming distorts metrics, presenting artificial product-market fit. In reality, a highly engaged community of 10K–100K real users can drive billion-dollar FDVs.

When Uniswap launched, it allocated tokens proportionally to the value created for the network – without needing to account for the 90%+ of volume driven by bots like projects do today. Since then, rising expectations of token rewards for minimal effort have reshaped the industry, creating a culture where users expect meaningful rewards without taking financial risk.

Points

Point programs took crypto by storm in ’23, allowing dApp developers to drive engagement through leaderboards encouraging key contributions tied to future token rewards. This adds surface area to identify Sybils and optimize for value.

Point launches that have shaped the meta:

Blur was one of the first scaled dApps to use points to incentivize sell-side (listings) and then buy-side (offers) liquidity, hyperfinancializing NFTs at the expense of asset value.

PortalCoin was the first token to launch by using points to capture mindshare using memetic incentives and tapping into X similar to Kaito.

Friend.Tech scaled to reach both CT and real celebs by leveraging referrals and key trading as the two key inputs to points. (Marketing + financial)

While these examples haven’t maintained market fit, leading protocols like EigenLayer and LayerZero have leveraged similar mechanics and become Web3 mainstays with Eigen leaving the majority of token in reserve for future campaigns.

Mindshare

The most recent crypto cycle—defined by memecoins—was even more speculative than the ICO boom of 2017 or the DeFi + NFT wave of 2021. With users increasingly pushing for zero-risk earning, and social contributions becoming increasingly obviously botted, Kaito took over the farming conversation by letting other projects pay for visibility on X via user content. Kaito attracted the top voices in the space and drove the majority of conversation on X, and then harnessed the community built through the $KAITO launch to generate content for other upcoming TGEs. This strategy led to a billion $$ token outcome with some real defensibility.

But as seen in the collapse of $LOUD, following a Loudio campaign that dominated both the leaderboard and timeline, attention alone doesn’t create value. $LOUD is now <3M FDV. Kaito is unique in that it uses social farming as proof-of-fit for their core social intelligence product.

Where We Go Now

While metas tend to linger, and mindshare will likely remain a hot topic on CT, our belief at Snag is that point systems should be both additive to UX and treated as a tool to optimize token spend as a marketing cost – just like any other P&L line item. The most damaging detour we’ve seen is the devaluation of financial contributions as a requirement for token rewards.

There are three types of contribution any dApp needs to care about:

Financial – Holding and trading tokens/NFTs drives sustainable revenue and floor prices.

Marketing – Referrals and social sharing feed user acquisition and project awareness.

Engagement – Core activities like validating transactions, contributing code, generating testnet transactions, or gaming build product strength and require user time.

The best point programs track all three contribution types as inputs, and require financial contributions as a key input to earn meaningful token rewards.

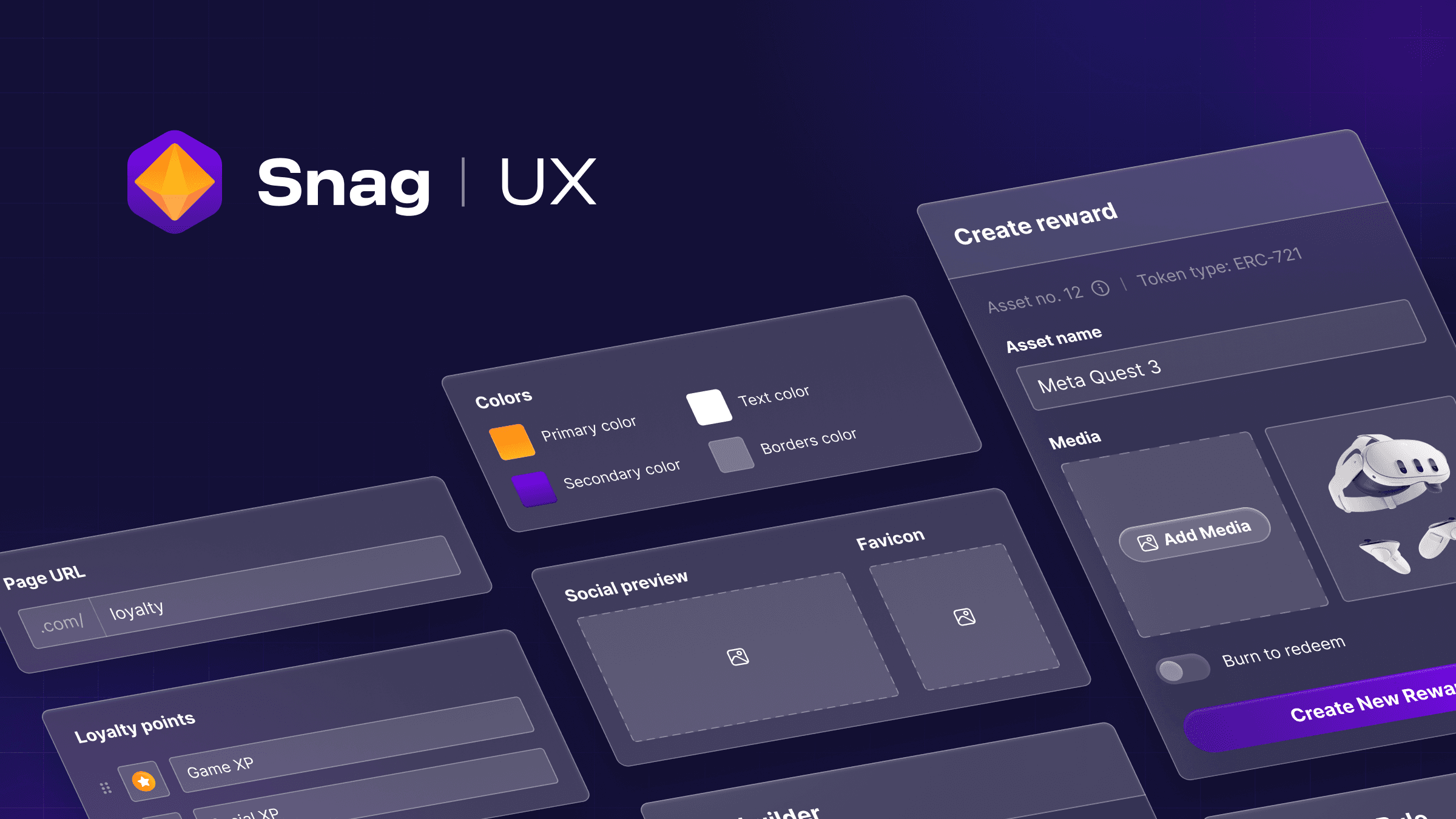

Snag is building developer APIs and self-serve tools to make integrating sophisticated point systems simple for any blockchain or dApp. Today, we’re delivering results for FLOW via self-serve tools, OpenSea via API, and top pre-TGE projects like Camp Network via our mobile App Hub and desktop APIs for incentivized testnets.

Our DMs are open – we’d love to help you build a sustainable reward program that empowers long-term believers.

Want to stay in the loop?

Subscribe to our mailing list to be the first to know about future blog articles.